Free Word Search

Free Word Search

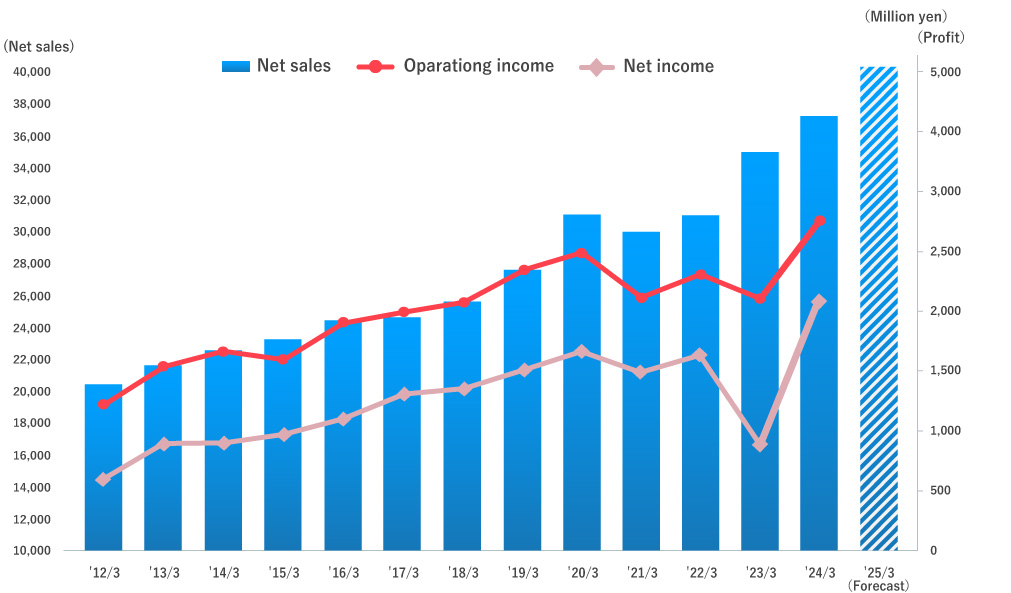

Achieving Stable Growth in Net Sales

In the information service industry to which our group belongs, system-related investments aimed at addressing labor shortages and improving operational efficiency among companies have continued. In addition, the advancement of cloud migration for existing systems and software, as well as the growing use of AI (artificial intelligence) and the expansion of IoT throughout society, have led to an increasing trend in demand for data center utilization.

Under these circumstances, our consolidated financial results for the six months ended September 30, 2025, were as follows: Net sales were 20,373 million yen (up 7.9% YoY), operating profit was 1,391 million yen (up 34.6% YoY), ordinary profit was 1,356 million yen (up 32.0% YoY), and profit attributable to owners of parent was 774 million yen (down 23.3% YoY).

Million yen

| 2012/3 | 2013/3 | 2014/3 | 2015/3 | 2016/3 | 2017/3 | 2018/3 | 2019/3 | 2020/3 | 2021/3 | 2022/3 | 2023/3 | 2024/3 | 2025/3 | 2026/3 (Forecast) |

|

| Net Sales | 20,374 | 21,587 | 22,528 | 23,229 | 24,434 | 24,617 | 25,615 | 27,591 | 31,097 | 30,016 | 31,169 | 34,988 | 37,763 | 38,987 | 42,250 |

| Operating profit | 1,214 | 1,538 | 1,664 | 1,598 | 1,918 | 1,992 | 2,081 | 2,345 | 2,501 | 2,155 | 2,367 | 2,129 | 2,887 | 2,640 | 2,750 |

| Return on equity (ROE) | 7.6% | 10.7% | 9.5% | 8.8% | 9.4% | 10.7% | 10.4% | 10.9% | 11.3% | 9.5% | 10.1% | 10.1% | 11.7% | 11.5% | - |