Free Word Search

Free Word Search

I-NET Corp., its subsidiaries, and its affiliates (collectively referred to as the “I-NET Group” or “the Group”) see contribution to society through ESG management as critical to achieving our corporate philosophy: “To create new systems and values using information technology and contribute to the realization of a prosperous, happy society.”

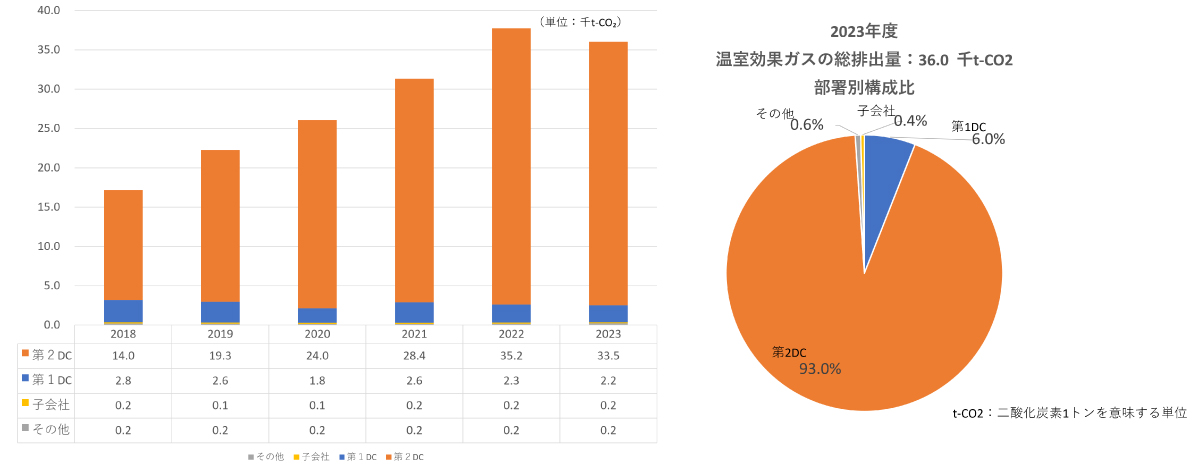

As the Group consumes a lot of electricity at its own data centers, addressing environmental issues including climate change is one of our important management challenges.

The Group analyzes and evaluates the risks and opportunities that climate change presents to the Group under multiple scenarios based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The results are reflected in the Group’s environmental strategy after reporting to, discussion in, and decision-making by a dedicated council established within I-NET Corporation—the parent company overseeing the Group—and the Board of Directors.

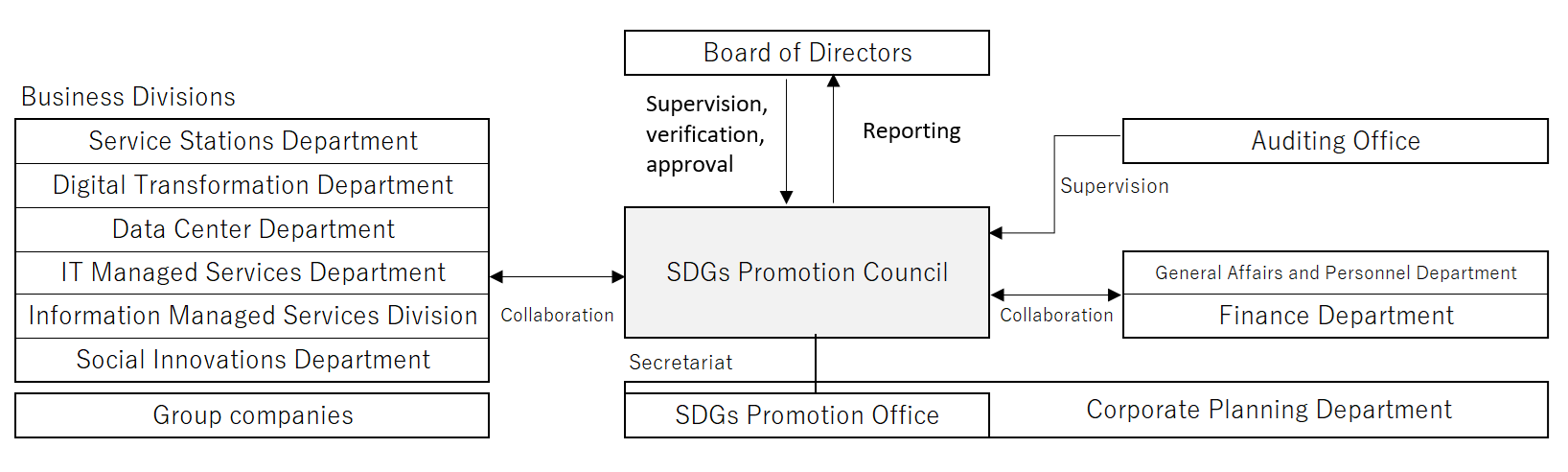

The I-NET Group has established governance policies and an execution structure to address environmental issues including climate change.

This allows us to deliberate and decide on important policies and measures for responding to climate change, leading to improvements and new initiatives.

In April 2022, the Group established an SDGs Promotion Office within I-NET to further advance ESG management.

We have also established an SDGs Promotion Council chaired by our Representative Director and Executive President.

The Council meets twice a year to report on and discuss SDG activities, working actively on SDG initiatives across the Group.

The SDGs Promotion Council discusses and decides on initiatives, risks, opportunities, policies, and disclosures related to climate change. It also monitors progress and reports resolutions and progress status to the Board of Directors.

The SDGs Promotion Office operates the SDGs Promotion Council and conducts specific examinations of group-wide initiatives, risks, opportunities, policies, and disclosures. It then extends resolutions into business activities through each business division and follows up on their implementation.

The Group has conducted scenario analysis in medium-term and long-term timeframe in order to examine the impact of climate change-driven societal transformations, policy and regulatory changes, and market changes on the Group.

| Category | Time frame | Target Year | Background |

|---|---|---|---|

| Medium term | Up to 10 years | 2030 | The period until 2030, the target year set by the 2020 Paris Agreement, is considered tod be the time when it will become a key point whether society can transition to carbon neutrality.Of particular note are transition risks (risks related to transition to a low-carbon economy). |

| Long term | 10–30 years | 2040 | The period with a long-term perspective up to 2050, which is the target year of almost all developed countries, including Japan, many international organizations, and major corporations to achieve carbon neutrality.The Company has set 2040 as the target year and will achieve it ahead of schedule. Particular note are physical risks (risks related to physical changes caused by climate change). |

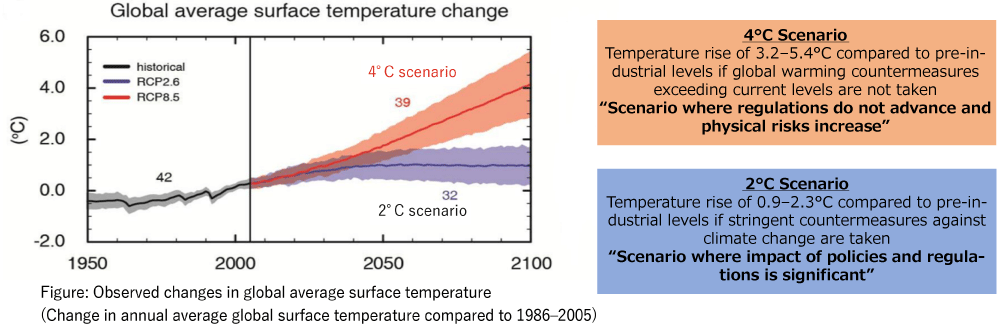

In conducting scenario analysis, we examined two scenarios—the 2°C scenario and the 4°C scenario—with reference to data published by organizations such as the International Energy Agency (IEA), based on the TCFD recommendations.

Until 2030, temperature changes progress similarly under these scenarios, but the difference between them is expected to widen after 2030. Under each scenario, we conducted our analysis considering transition risks (risks related to transition to a low-carbon economy) that are expected to manifest by 2030 and physical risks (risks related to physical changes caused by climate change) that are expected by 2040.

Risks for the Company’s businesses under 2℃/4℃ scenarios

| Item | Time frame | 2℃ Scenario | 4℃ Scenario | |

|---|---|---|---|---|

| Transition Risks | Introduction/increase of carbon pricing (carbon tax) | Medium term | High carbon taxes are introduced, goods/services prices rise, facility utilization costs increase. Emissions trading is also active. | Carbon pricing remains at current levels, carbon tax additions have little momentum. Emissions trading also maintains current levels. |

| Introduction of renewable energy | Medium term | Renewable energy utilization becomes commonplace, introduction costs increase significantly. | Renewable energy and fossil fuels are used in combination. | |

| Delay in providing systems and services responding to climate change | Medium term | Environmental response and performance become selection criteria for service use, non-compliance declines. | Environmental response becomes an important judgment factor for service use, maintaining competitive advantage. | |

| Reputational decline due to delayed response | Medium term – long term | The company becomes excluded from investment by institutional investors, funding from financial institutions may also become difficult. | Reputational decline becomes one judgment factor for investment by institutional investors. Financing costs from financial institutions may rise. | |

| Physical Risks | Increase in natural disasters | Long term | Disasters due to abnormal weather occur, rarely become severe, but are not frequent. | Frequent occurrence of extreme disasters, concentrated downpours and large typhoons occur frequently. Recovery costs from damage increase significantly, disaster prevention becomes an important issue. |

| Temperature rise | Long term | Average temperature rises but not as much as in the 4°C scenario. Energy-saving measures advance further. | As the average temperature rises, extremely hot days increase sharply, frequency of air-conditioner use increases significantly, increasing cost burden. |

Information Processing Services and System Development Services account for about 96% of net sales in the Group’s businesses.

In FY2022, we conducted scenario analysis for 2°C and 4°C temperature rises based on the TCFD recommendations, looking at Information Processing Services, which includes data center operations that are more susceptible to the impact of climate change.

As 99% of the Group’s electricity usage comes from data centers, we only analyzed Information Processing Services.

| 2℃ Scenario | 4℃ Scenario | |||

|---|---|---|---|---|

| Impact | Financial Impact |

Impact | Financial Impact |

|

| Information Processing Services | ・Electricity charges from fossil fuels increase significantly due to high carbon taxes, increasing data center (DC) operating costs due to higher electricity usage costs. ・Facility investment costs such as for energy-saving equipment, air-conditioning equipment, and environmental measures increase. |

High | ・DC operating costs increase due to the impact of extreme disasters, rising temperatures, etc., with concerns that DC operations themselves will become impossible. ・Facility investment costs such as for energy-saving equipment, air-conditioning equipment, and environmental measures increase. |

High |

| System Development Services | ・Expenses such as electricity charges at development sites are expected to increase due to sharply rising electricity rates. ・However, the impact of cost increases due to electricity rates is relatively small, as electricity consumption in this service is negligible compared to the electric power consumed by DCs. |

Low | ・Expenses such as electricity charges at development sites are expected to increase due to sharply rising electricity rates. ・However, the impact of cost increases due to electricity rates is relatively small, as electricity consumption in this service is negligible compared to the electric power consumed by DCs. |

Low |

| Item | Risk Factors | 2℃ Scenario | 4℃ Scenario | ||

|---|---|---|---|---|---|

| Overview | Financial Impact |

Overview | Financial Impact |

||

| Transition Risks (2030) | Introduction/increase of carbon pricing (carbon tax) | Risk of being unable to pass on the cost increase in servers and equipment, and the rise in electricity rates | Medium | Risk of being unable to pass on the cost increase in servers and equipment, and the rise in electricity rates | Low |

| Introduction of renewable energy | Risk of being shut out of value chain due to insufficient procurement | High | Risk of being shut out of value chain due to insufficient procurement | Medium | |

| Delay in providing systems and services responding to climate change | Risk of delay in adapting to technological changes and entering new service areas | Medium | Risk of delay in adapting to technological changes and entering new service areas | Low | |

| Reputational decline due to delayed response | Risk of decline in corporate value and being shut out of value chain | Medium | Risk of decline in corporate value and being shut out of value chain | Low | |

| Physical Risks (2040) | Increase in natural disasters | Risk of DC stoppages due to increased blackouts and stalled fuel supply during blackouts | Medium | Risk of DC damage due to abnormal weather. Risk of DC stoppages due to increased blackouts and stalled fuel supply during blackouts | High |

| Temperature rise | Risk of declining price competitiveness if facility investments do not keep up with increased air-conditioning costs, etc. | Medium | Risk of DC maintenance becoming difficult due to facility investments not keeping up with increased air-conditioning costs, etc. | High | |

Transition Risks: Risks related to transition to a low-carbon economy; Physical Risks: Risks related to physical changes caused by climate change

| Aspect | Overview | Financial Impact | |

|---|---|---|---|

| 2℃ Scenario |

4℃ Scenario |

||

| Resource efficiency | Data centers (DCs) require large amounts of electricity and cooling systems, but improving energy efficiency can reduce costs and environmental impact. Developing and installing energy-saving systems and cooling technologies can improve DC operating efficiency. This can present business opportunities related to energy-efficiency improvements such as providing these technologies and consulting services. | High | Medium |

| Energy source | As the use of renewable energy is demanded, DCs can play a role in promoting the transition to renewable energy. By partnering with renewable energy power plants and introducing renewable energy, services can be provided as DCs that utilize clean energy. Furthermore, opportunities for DCs to enter energy markets can be expected through collaborations with energy suppliers and the establishment of power trading platforms. | High | Medium |

| Products/ Services |

DCs play a role in providing corporate and organizational data management and cloud services. As climate change risks increase, the importance of DCs for disaster preparedness and business continuity planning will grow. Expanded demand for services responding to climate change risks can be expected, such as providing robust disaster recovery services and data backup solutions, as well as strengthening security measures. | High | High |

| Market | As climate change countermeasures become an important issue for companies and organizations, companies are required to evolve toward sustainable business models. By providing data and reports on energy efficiency and sustainability, DC operators can help clients reduce environmental impact and support sustainable business strategies. Demand for environmental services in the market is also expected to expand, including for collecting/analyzing data related to sustainability metrics and providing reporting tools. | High | Medium |

| Resilience | Companies are required to improve resilience against natural disasters caused by climate change. Through DC design and operation, DC operators can take measures to address disaster risks such as earthquakes and flooding. Demand is expected to increase for services and solutions to improve resilience, such as constructing robust infrastructure, developing disaster response plans, and providing backup facilities. | High | High |

| Anticipated Risks | Time frame | Responses to Risks |

|---|---|---|

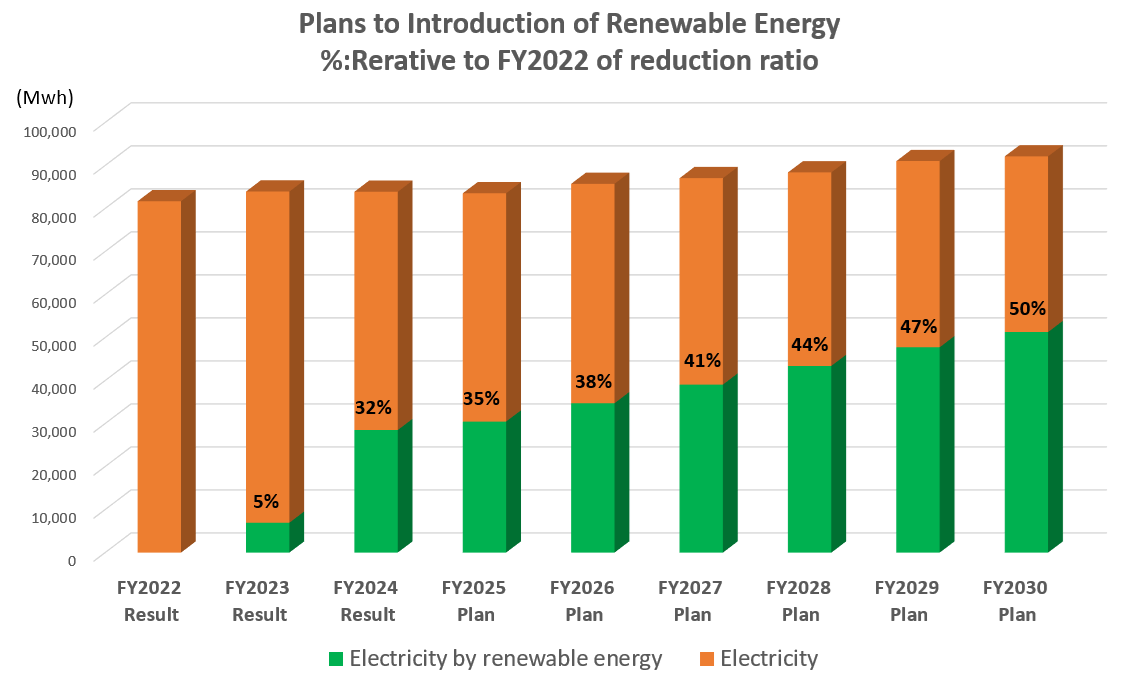

| Introduction/increase of carbon pricing (carbon tax) | Medium term | Adopt electricity from renewable energy sources for data centers by FY2024. Mitigate impact of carbon taxes by increasing reliance on electricity from renewable energy sources and reducing dependence on fossil fuels. |

| Introduction of renewable energy | Medium term | Adopt electricity from renewable energy sources for data centers by FY2024. Promote green measures concurrently, such as advancing the installation of solar power systems at data centers. As renewable energy sources may become depleted in the future, secure stable utilization through long-term contracts. |

| Delay in providing systems and services responding to climate change | Medium term | Achieve data center greening early to enable early implementation of environmental response systems/services and mitigate risks. |

| Reputational decline due to delayed response | Medium term – Long term | Bring forward data center greening to reduce the possibility of reputational decline due to delayed response. |

| Increase in natural disasters | Long term | Improve resilience against natural disasters and mitigate their impact through measures such as enhancing DC backup power sources (adding generators, expanding fuel tanks, etc.). |

| Temperature rise | Long term | Strengthen data center cooling capacity and periodically implement equipment maintenance/updates to improve ability to respond to temperature increases. |

Through scenario analysis based on our TCFD declaration, the Group identifies important climate change-related risks and opportunities, and grasps and assesses the situation. In addition, assesses and makes decisions on operational risks that are closely related to climate change risks in the Risk Management Committee, which holds monthly meetings to manage operational risk.

The SDGs Promotion Council, meeting twice a year, reviews overall risks, grasps the status of countermeasure implementation, and reflects insights into the environmental strategy for the entire Group. In addition, the SDGs Promotion Office works with relevant departments and divisions to address the risks identified by the SDGs Promotion Council.

When risks or issues arise, the officer in charge of SDGs and the SDGs Promotion Office grasps the content and promptly reports it to the executive management team. Executive management and the Board of Directors oversee and control these reports, and give instructions and orders as needed to respond to risks and issues.

| FY2030 | FY2040 | |

|---|---|---|

| Metrics and Targets | Reduce greenhouse gas emissions (Scope 1, 2) by the Group by at least 33.6% compared to FY2022 levels. | Reduce greenhouse gas emissions across the Group’s entire value chain by 100%. |

| Specific Responses | (1)Switch a portion of electricity used at own DCs to electricity from renewable energy sources (by FY2024). (2)Introduce on-site PPAs such as solar power generation (by FY2024). (3)Energy saving, suppressing equipment heat generation, etc. (achieve PUE* of 1.40). |

(1)Formulate effective strategies as I-NET Group and further promote use of renewable energy (introduce additional renewable energy). (2)Switch electricity used at own data centers to 100% electricity from renewable energy sources. |

Response to Scope 3: Plan to determine response policy during FY2040 through investigation into emissions across the Group’s entire value chain.

* PUE (Power Usage Effectiveness): Indicator showing DC electricity usage efficiency. The total electricity consumption of the data center divided by the electricity consumption of ICT equipment such as servers.